Discover what kind of tax credit you can get for going solar

Everybody can appreciate a tax break, especially when it comes to big purchases. Whether you’re looking to install solar panels, invest in a solar plus storage system or add a battery to an existing system, you may qualify for a tax break from the government.

The residential clean energy credit is one of the best incentives available to taxpayers who own their solar panels or other clean energy equipment. This incentive is a dollar-for-dollar income tax credit of up to 30% of the cost of installing your home system.

That means you could reduce what you owe in federal income taxes by thousands of dollars, providing you meet the following requirements:*

- You own your system outright, meaning you purchased your system with cash or financed it with a loan.

- The system is located at your U.S. residence, which is either your primary or secondary residence for the year you’re claiming.

- You have an income tax liability, since this is what the incentive reduces.

- The system is either new or in use for the first time, as this credit only applies to the original installation.

The residential clean energy credit covers an array of distributed energy resources: solar electric systems, small wind energy, geothermal heat pumps, solar water heaters, fuel cells and battery storage technology — all used onsite, all subject to certain guidelines.*

In This Article

Discover what kind of tax credit you can get for going solar

The History of the Federal Solar Tax Credit

How Does the Solar Investment Tax Credit Work?

Both Solar Batteries and Standalone Batteries Qualify

How to Claim the Federal Tax Credit for Solar

What About State Solar Tax Credits and Rebates?

Renewable Energy Certificates (RECs)

What Expenses Are Included When I Apply for My Federal Solar Tax Credit?

For the purpose of this article, we’ll focus on the solar and storage aspect of this federal incentive.

The History of the Federal Solar Tax Credit

If you’re familiar with the solar industry, you may know the federal solar tax credit as the investment tax credit (ITC), which was created by the Energy Policy Act of 2005 and enacted the following year. The ITC quickly became an economic engine, helping the U.S. solar industry grow more than 200x and creating hundreds of thousands of jobs along the way.*

The investment tax credit was set to expire several times, but the solar industry successfully advocated for multiple extensions, including the passing of the Inflation Reduction Act (IRA) in 2022.

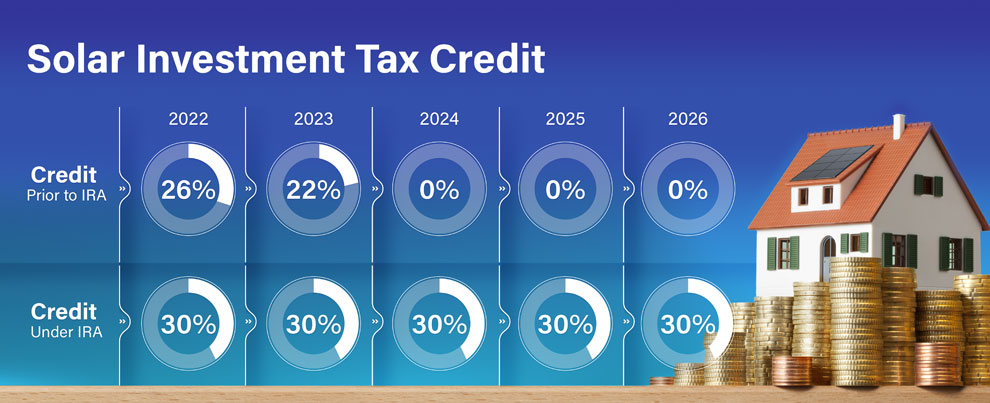

Prior to the IRA’s passing, the ITC was being phased out. Originally set at 30%, this residential incentive dropped to 26% for systems installed in 2022 and 22% in 2023, before it was to be eliminated in 2024.

But clean energy enthusiasts rejoiced when the IRA not only restored the ITC to its original percentage, but also extended it for a decade. This means eligible residential taxpayers who qualify can now claim 30% of their system costs through 2032. After that, the ITC step-down will mirror its previous plan: decrease to 26% in 2033 and drop to 22% in 2034 before expiring the following year.

How Does the Solar Investment Tax Credit Work?

A tax credit is a direct reduction in the amount of taxes you (as an individual) owe to the government. The ITC isn’t a tax deduction that reduces your taxable income. Rather, it works by diminishing or eliminating your actual tax liability, providing a dollar-for-dollar reduction in your owed taxes for a specific year.

You may qualify as long as you have tax liability in the year your system is installed and you buy the system outright — any third-party owned systems, meaning you sign a lease or power purchase agreement (PPA), won’t qualify. This also means the ITC is a one-time credit.

However, if you don’t have enough tax liability to claim the entire credit in one year, you can carry any leftover amount forward to the next year as long as the tax credit is still in effect (as of now, that’s through 2034).

An unusual feature of the ITC is that there’s no cap on the amount you can claim, providing it’s no more than 30% of the total costs of your energy equipment, including installation.

That’s a good thing.

The ITC extension provides market certainty. It promises to keep the benefits of solar energy within reach for homeowners across the nation. When combined with the potential reduction in electricity bills, a solar system that qualifies for the solar tax credit can help remove cost-related barriers to adopting sustainable energy at home.

Both Solar Batteries and Standalone Batteries Qualify

Another monumental win with the IRA was expanding the federal tax credit to include eligible equipment like energy storage devices with capacities of 3 kilowatt-hours (kWh) or more. This includes batteries powered by solar panels as well as standalone storage, meaning devices you can plug into the grid.

In years past, home battery systems had to be charged by renewable energy sources like wind or solar in order to qualify for the 30% tax credit. That’s no longer the case.

How to Claim the Federal Tax Credit for Solar

You’ll claim the residential tax credit when you file your annual federal income tax return. You must claim the credit for the tax year when the property is installed, not when it’s purchased.

First and foremost, seek professional tax advice to ensure you’re eligible for the credit. Then consult your tax advisor to complete IRS Form 5695, ‘Residential Energy Credits,’ and include the final results of that form on your IRS Schedule3/Form 1040.

Keep in mind that the federal solar tax credit isn’t a refund. And because it’s nonrefundable, if this credit reduces your overall tax bill below zero, don’t expect the IRS to send you a check for the difference.

Because it's a credit instead of a reduction, the amount you're eligible for can be knocked off your taxes. Depending on your system costs, this could potentially result in greater savings than a tax deduction would — since a deduction only recoups a portion of your expenses by reducing your taxable income.*

What About State Solar Tax Credits and Rebates?

Some states offer additional tax incentives, rebates, and property tax exemptions for installing a home solar system. With these state-level programs, you may be able to deduct a portion of the cost of your solar panel system from your state tax bill, similar to how it works with federal tax credits. Consult your tax advisor regarding how state incentives and credits may affect your tax liability.

Solar and storage credits vary significantly by state, but your Sunnova dealer will be up to date on your local incentives and can steer you in the right direction.* You can find more state-specific incentives at www.dsireusa.org.

What Local Solar Rebates?

It may be possible to receive a cash rebate or other incentive from your municipality, utility company, or other organization that wants to promote solar energy. These local rebates can help to further reduce your system costs and are generally available for a limited time. They may end once funding has run out, or a certain amount of solar has been installed in the community.

Renewable Energy Certificates (RECs)

Many states have adopted some form of clean energy targets or renewable portfolio standards (RPS) that require utilities to generate a certain percentage of their electricity from solar power. If you live in one of these states, your rooftop solar system will generate solar Renewable Energy Certificates (RECs) based on the amount of clean energy your panels produce.

These RECs (or SRECs if we are referring to solar-only) represent the environmental benefits of renewable generation, not the actual electricity. They are essentially a certificate of property rights over one unit of this “greenness.”

Now, back to those federal tax credits.

What Expenses Are Included When I Apply for My Federal Solar Tax Credit?

All these costs may be included on your IRS Form 5695. Your Sunnova dealer can help you by itemizing them for you.

- Cost of the solar panels

- Labor costs for onsite preparation and original installation, including permitting fees, inspection costs and developer fees

- Additional equipment, such as wiring, inverters and mounting equipment

- Residential solar batteries that store your solar energy for later use

- Sales tax on eligible expenses

Sunnova Customer Stories

Hear Sunnova reviews from customers, in their own words, about their experience with Sunnova SunSafe® home solar and battery storage. For more information on Sunnova and our home energy service offerings, click here.

So, What Are You Waiting For?

At Sunnova, we’re committed to providing a better energy service at a better price. As the price of electricity continues to rise, the sooner you install solar on your home, the sooner you can protect yourself from volatile energy costs.

Ready to make the sunshine work for you?

At Sunnova, we are energy service experts, not tax experts. Consult your tax advisor to determine the incentives for which you may qualify. Sunnova makes no guarantees regarding eligibility for tax benefits. Sunnova is not responsible for or liable for any errors or omissions in regard to your personal tax and finance situation or obligations. The information in this article does not, and is not intended to, constitute legal advice.