America’s greatest effort to tackle climate change is officially underway. The Inflation Reduction Act (IRA) has several goals, but climate makes up the largest portion of the bill’s spending — nearly $370 billion. It is the largest climate spending program in U.S. history.

The IRA will help the U.S. become a major manufacturer of solar and other clean energy technologies while accelerating our transition to a low-carbon future. Through tax credits and rebates for various renewable technologies, the legislation will cut carbon emissions by 40% by 2030, say Senate Democrats.*

Making EVs, Solar Plus Storage More Accessible

From rooftops to roadways, the IRA may forever alter how we commute and power our homes. Tens of billions of dollars are going toward lowering the cost of electric vehicles and installing solar with energy storage.

Do we still need incentives to drive the deployment of renewables?

Sunnova CEO John Berger weighs in:

“The reality is that coal, oil and natural gas have been cheap for a long time — until just recently. So, there hasn’t been a strong financial incentive for consumers to shift to renewables, other than high local power prices in states like California and Hawaii. This led to an uneven adoption of solar across the country.”

As the price of gasoline began to skyrocket and surging natural gas prices increased utility rates, renewables have become even more attractive for Americans looking for relief. This Act will help make electric cars more accessible to the masses by extending the federal $7,500 tax credit for new EVs and hybrids. It will also create a new credit, up to $4,000, for used versions of these vehicles.*

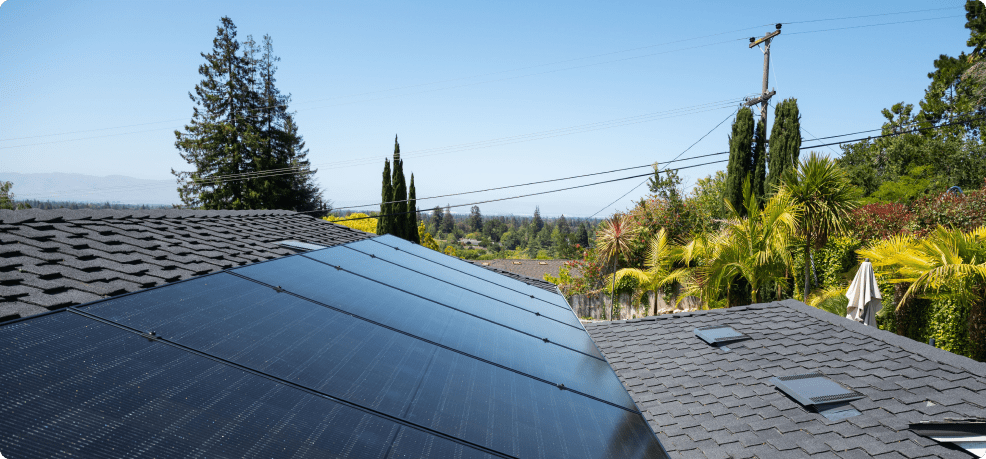

The federal tax credit for residential solar, called the investment tax credit (ITC), was being phased out and would have expired next year, had the IRA not passed. There are varying levels of this federal tax credit — how much you can take off the cost of a solar system that could include batteries, EV charging and load management technologies.

At the beginning of 2022, residential customers who owned their solar system could receive a 26% tax credit. This new legislation will not only restore the ITC to its original 30%, but it will ensure the tax credit is available for the next 10 years. For the first time in history, the solar industry has certainty in policy.

Addressing National Security and Supply Chain Delays

Aside from assurances for homeowners and investors, the IRA also offers certainty on the trade side.

“Even though Sunnova doesn’t manufacture anything, it’s a huge win to bring manufacturing jobs home to the U.S. We view this as a national-security-important industry, just like the semi-conductor industry,” Berger says.

By creating our own supply chain rather than relying on foreign goods, the IRA promises to strengthen our national security even further. Positioning the U.S. as a domestic manufacturer of solar modules, batteries, and other technologies can help us create thousands of jobs and eliminate some of the tariff fights that have hung over our industry for years.

At Sunnova, we believe that in order to address supply chain delays, we need to increase our manufacturing and equipment production. This Act provides just that, by making sure we have the supply needed to serve the accelerated demand.

Environmental Justice for Vulnerable Communities

In addition to the opportunities the IRA provides to everyone, the Act offers even more for low-to-moderate income (LMI) communities. This legislation has the power to change the lives of Americans by cutting their energy bills and creating new manufacturing jobs here at home to proliferate the adoption of distributed energy resources like solar plus storage.

In fact, some LMI communities can add another 10-20% bonus credit on top of the 30% ITC.*

That’s as much as a 50% tax credit for qualifying solar projects, enabling these communities to access much-needed clean energy technologies.

Rebates are also available for energy efficiency and weatherization improvements, to an all-electric home.

Should You Install Solar Now or Wait?

Now that the ITC has been extended, many wonder if they should install solar now or wait? These incentives are designed to spark widespread solar adoption, making clean energy accessible to more Americans across different income brackets.

While this Act is a critical step in lowering inflation and reducing the cost of living, we are still facing a global energy crisis on top of a climate crisis. With the average home electric bill up nearly 4% over 2021,* the IRA makes it more appealing for Americans to install solar and battery storage — and use clean energy during peak hours to avoid high utility rates.

The best thing you can do as a homeowner is to act now. When you look at what’s happening globally and the war in Ukraine, many believe these are only going to drive electricity prices higher.

At Sunnova, it’s our mission to create a better energy service at a better price. Each day we strive to make clean energy more affordable and reliable. With the help of these extended tax credits, American homeowners can adopt these renewable technologies faster.

Join us on the journey to a clean energy future: