Across the nation, more businesses, utilities, and municipalities are facing pressure to meet clean energy goals. Oftentimes, the easiest way to do this is by purchasing renewable energy credits (or certificates) called RECs. Think of a REC (pronounced wreck) as a currency of renewable energy. Anyone who can’t install and maintain a solar system or wind turbine can still support green energy and reduce their carbon impact, thanks to RECs.

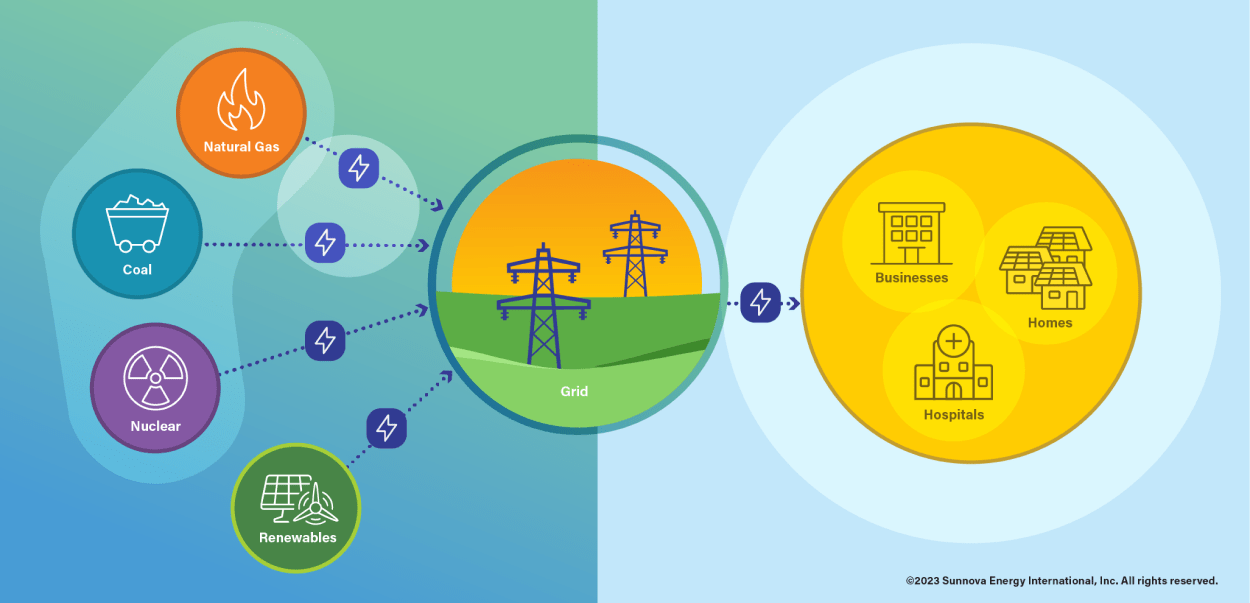

Before we explain how they work, consider the power grid. All sources of energy — coal, natural gas, renewables, nuclear — feed into the grid. They’re like tributaries flowing into a river. By the time this river of electricity runs through the distribution lines and into your home, it’s impossible to tell where that power came from.

If you can’t track clean energy on the grid, how can you buy or sell it? This is where RECs come in.

How Do Renewable Energy Credits Work?

Picture solar panels absorbing sunlight and generating carbon-free electricity to power your home. This process creates two sources of value: the electricity itself and the “green” attributes of producing fossil fuel-free electricity.

RECs represent the latter — the environmental benefits of renewable generation, not the actual electricity. Think of RECs as a certificate of property rights over one unit of this “greenness.”

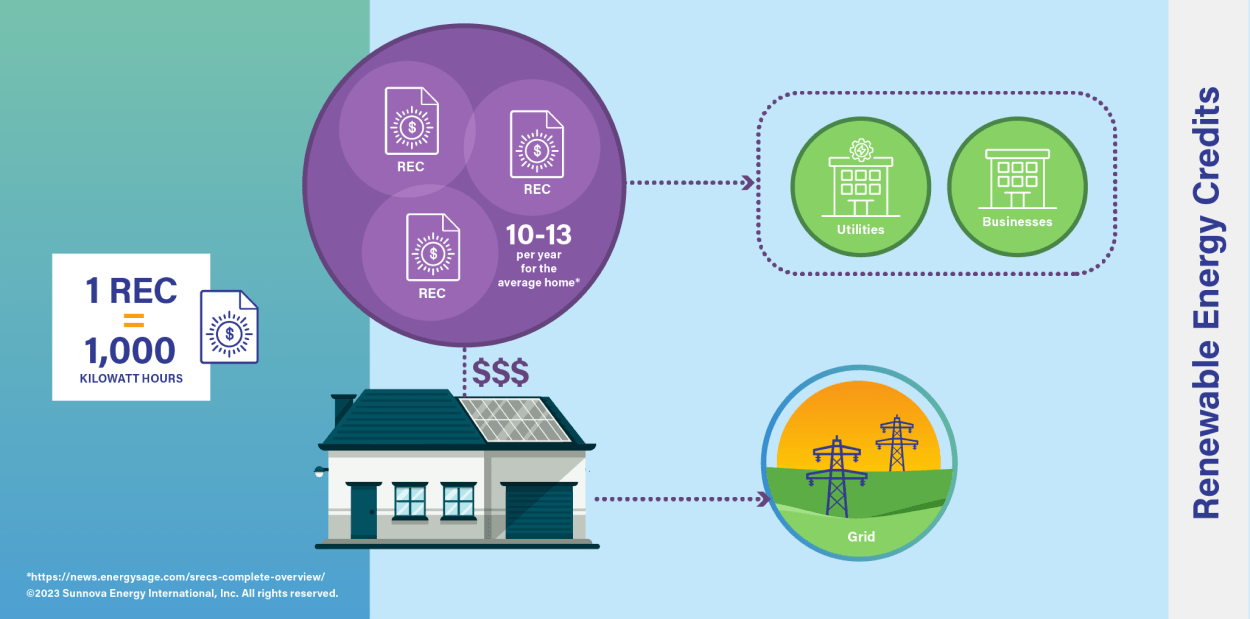

Each time a renewable energy source produces 1,000 kilowatt-hours (one megawatt-hour) of electricity — the average amount of electricity an American home uses in a month — it generates one REC.* Whoever owns the solar system, wind turbine, geothermal facility, etc. may keep or sell each REC.

Once you buy a REC and say that you’re using green power, that REC can no longer be sold or used by someone else. This is called “retiring” it in the tracking system to prevent someone else from claiming it.*

Who Buys and Sells Renewable Energy Credits?

Once the green energy is fed to the grid, the associated REC can be sold to a party that wants to offset its carbon emissions or is betting on the value of energy credits.*

There are different motivations for buying and selling these credits. Most times, buyers include utilities and other generation owners that are required to meet renewable portfolio standards for compliance reasons. Other parties want to claim the environmental benefits and say their company or organization is “100% powered by clean energy,” and these are usually large companies working to meet sustainability goals.

RECs make it possible to support renewable energy even if you can’t generate it yourself. And, as the demand for RECs increases, so does the need to produce more clean energy.

Renewable Mandates and the Ever-Changing Price of RECs

RECs are priced differently depending on whether they are compliance or voluntary markets. Compliance RECs are used to meet a state’s renewable energy mandates. At the beginning of 2022, a total of 31 states and the District of Columbia had policies in place requiring utilities to supply a certain amount of electricity from carbon-free sources.* In these states, if utilities don’t generate enough clean energy on their own, they have to purchase RECs to meet a given state target. The demand is higher for compliance RECs, and so is the price.

RECs are typically less expensive in voluntary markets, where the interest is driven by sustainability goals, rather than mandates. Voluntary RECs appeal to companies eager to tout their positive environmental impact. Prices can range from a few dollars per REC to many hundreds of dollars, depending on where the renewable energy source is located.

How Much Money Could I Get for My RECs?

You won’t get rich from selling your RECs on the open market, but they are certainly worth something. Use the money to install more panels (and earn more RECs) or put it toward an electric vehicle and charge the battery on clean power from the sun.

Prices in voluntary markets depend on supply and demand, while prices in compliance markets depend on how much regulated entities like utilities are willing to pay to avoid the penalty of non-compliance.5 You can expect to earn a few hundred dollars per year, depending on the size of your system.

RECs foster a transition away from fossil fuels and lead to fewer carbon emissions — a win for our planet and solar customers alike.

Ready to make the sunshine work for you?