It's the number one question everyone asks when considering solar panel installation: "How much do solar panels cost?"

The good news is that the average cost of solar panels has experienced a sharp decline over the past decade. A handful of factors determine the final price of a solar photovoltaic (PV) system, including its size, component options and configuration, labor costs, local permitting costs and available incentives and tax credits.

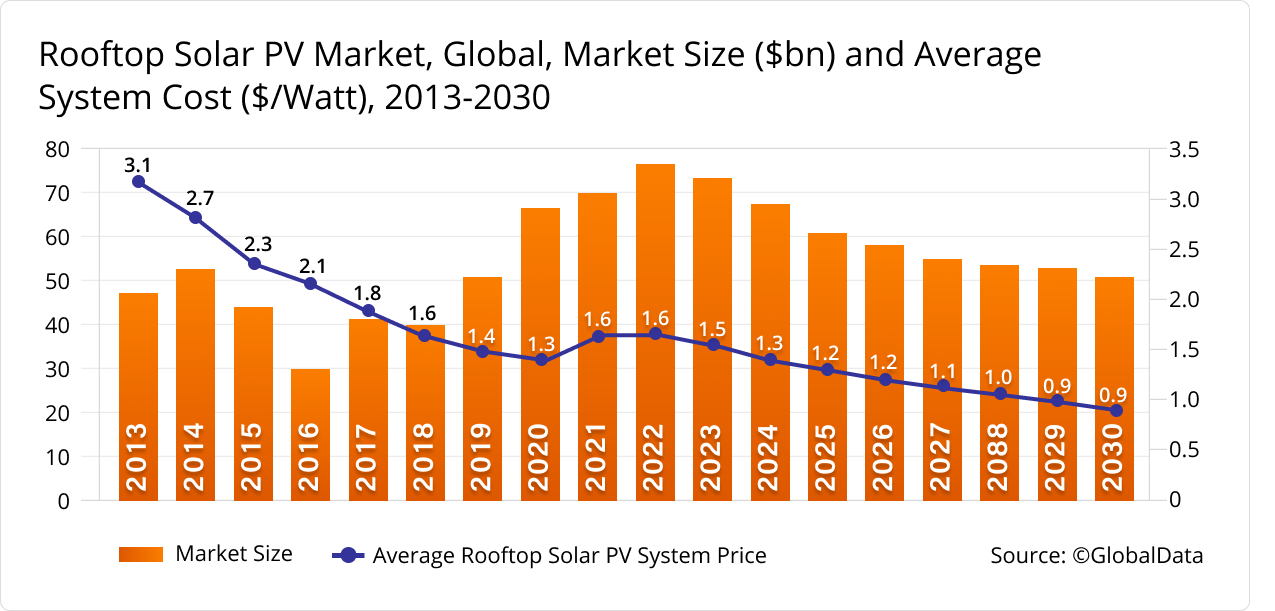

From 2010 to 2020, the cost of rooftop solar panels dropped 64%, thanks to greater efficiencies in solar technology, and a reduction in hardware costs.* While long-term trends are on the decline, the residential solar industry was not immune from supply chain issues and pandemic-related market volatility, which caused slight price increases from 2020 to 2023. However, from now through 2030, industry analysts expect the average cost of solar panels to decline, thanks to advances in technology and the increasing scale of production.*

The price of a solar electric system is measured in dollars per watt, and solar panels are rated in watts or kilowatts (kW) (1 kW = 1000 W). Today, the price of solar panels for a home is currently averaging $3-5 per watt, depending on the state you live in the size of your PV system and other factors mentioned above.

In This Article

Are Solar Panels Cost-Effective?

The Impact of the Inflation Reduction Act

Solar Panel Efficiencies Continue to Improve

2023 Federal Solar Tax Credits and State Solar Incentives

What is Net Metering and Why is it Important?

What About the Solar Panel Installation Cost for My Home?

Leasing Solar Panels vs. Buying Solar Panels

What Impact Does Adding a Battery Have on Solar Panel Cost?

Efficiency improvements and declining costs have encouraged homeowners to install larger systems. While most systems range from 5 kW to 11 kW, today’s average residential solar system is 7.2 kW.* Considering this size, the cost of solar panels will range from $21,600 to $36,000 before tax credits or other local incentives.

While solar prices have continued to decrease in recent years, they’ve done so at a slower pace — and the cost of solar has essentially stabilized.*

This means there’s no better time to install solar panels on your home.

Are Solar Panels a Good Investment?

Solar technology is constantly improving. The sharp decline in the cost of solar has been driven largely by the efficiency at which solar cells convert sunlight into clean energy. The real question to ask today is, "Are solar panels a good investment in 2024?"

The answer is yes.

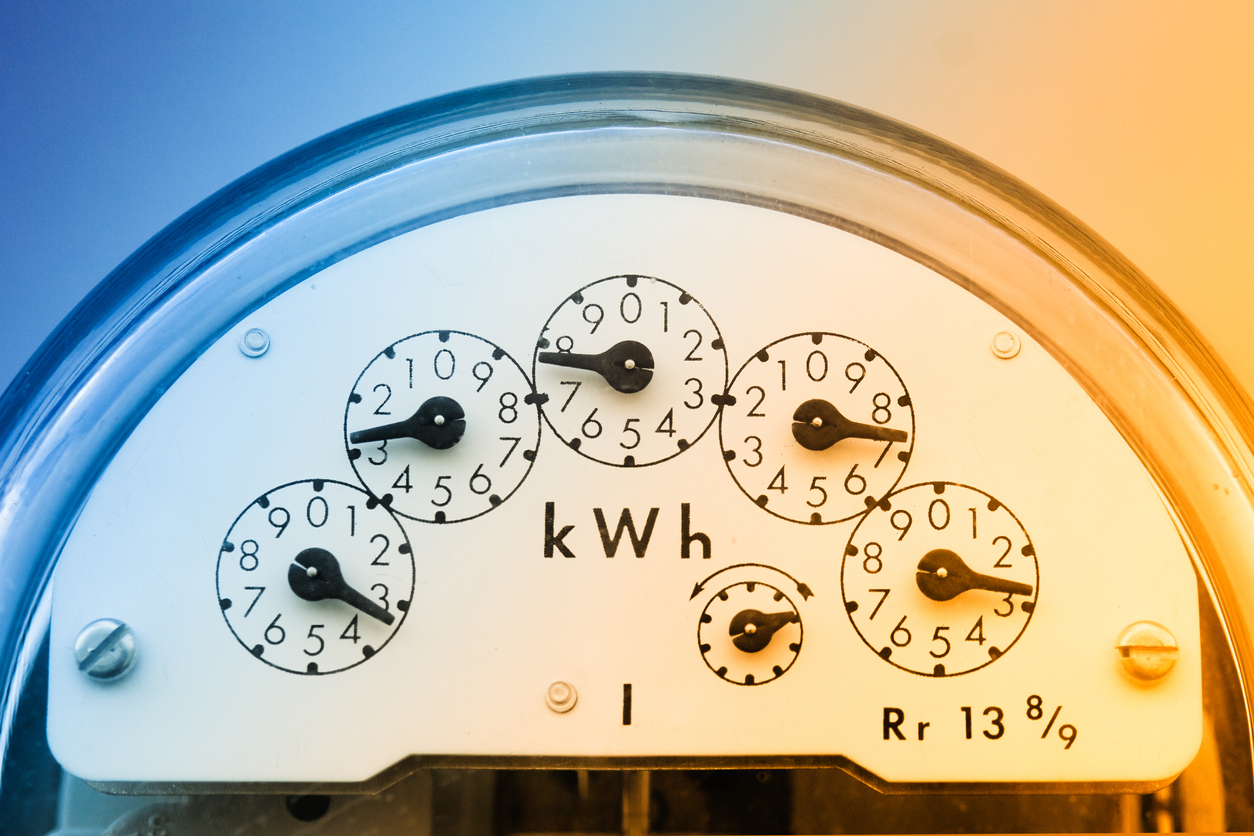

Residential electricity rates in 2024 are expected to decline slightly (less than 1%) from last year for an average of 15.81 cents per kWh.* The U.S. Energy Information Administration, which provides price forecasting, attributes the steady electricity rates to the stable costs of generation fuels (namely natural gas) that won’t cause wholesale energy prices to spike considerably this year. However, in 2025, the EIA expects residential rates to average 16.19 cents per kWh, a 2.4% increase over this year.

States with the highest electricity rates (as of November 2023):*

- Hawaii: 43.5 cents per kWh

- Rhode Island: 31.3 cents per kWh

- California: 29.41 cents per kWh

- Massachusetts: 28.3 cents per kWh

- Maine: 27.42 cents per kWh

- Connecticut: 26.9 cents per kWh

- New Hampshire: 25.8 cents per kWh

- Alaska: 24.1 cents per kWh

As electricity prices continue to increase across the country, rooftop solar makes more sense financially. Most people understand that by installing residential solar panels, you may reduce (or even eliminate) your monthly electricity bill by producing your own clean power right from your rooftop. But did you know that investing in solar today can protect you against future increases in electricity costs?

Click on the interactive map below to see how much the price of electricity has increased — or decreased — in your state.

The Impact of the Inflation Reduction Act

In August of 2022, Congress passed the Inflation Reduction Act (IRA), calling for a 10-year extension of the 30% solar federal tax credit. This long-term extension provides certainty and will help the residential solar industry grow and recover from supply chain issues, as well as permitting and utility interconnection delays lingering from the pandemic.

By 2030, the IRA is estimated to drive the installation of 950 million solar panels, strengthen America’s energy independence and create hundreds of thousands of well-paying jobs in clean energy.*

Solar installers across the U.S. are already experiencing the benefits of the stabilizing impact of the long-term federal tax extension. Financiers report that higher tax equity contributions have enabled them to pay installers more competitive rates, which generate more sales.* Companies that offer third-party ownership systems can also qualify for adders under the IRA for domestic content, low-income and energy communities, offering additional cost reductions.

How Efficiency Improvements Impact Solar Panel Costs

Solar panels are converting more of the sun’s energy into electricity than ever before, meaning you need fewer panels to generate the same amount of energy. These advances in technology have played a crucial role in reducing the average cost of solar panels.

Some of the first silicon solar cells in the 1950s had around 6% energy conversion efficiencies.* Due to the many recent advances in solar cell technology over the past five years, the average panel conversion efficiency has increased from 15% to between 15-20%, with the highest-efficiency panels now reaching 23%.*

Solar panels with greater efficiency levels generate more energy per square foot by using space more efficiently. Not only is this ideal for limited roof space, but reducing the number of solar modules also lowers hardware costs — thereby driving down the overall price of solar panels.

2024 Federal Solar Tax Credits and State Solar Incentives

When you own your home solar system, you are eligible to apply for available federal and state incentives and rebates. This can help minimize the cost of solar panels on your rooftop or property.

As mentioned, the federal solar tax credit — also called the investment tax credit (ITC) — enables eligible customers to claim 30% of their solar system costs from their taxes.*

Several states also offer solar tax credits and solar tax rebates. People who own their solar system and/or battery in participating states may be able to claim these expenses on their local taxes or receive cashback on their installation. While you may be eligible for a solar tax credit or a solar tax rebate with the purchase of a home solar system, please remember that tax incentives are subject to change.

Click on your state to see what credits and incentives you may be eligible to apply for.

Pennsylvania

Federal Tax Credit (only for loan products)

- May be eligible to claim some of the system’s cost as a credit on your federal taxes.

Federal tax credit

- You may be eligible for a federal tax credit with the purchase of a solar system and/or battery. To qualify for the tax credit, you must have federal income tax liability at least equal to the value of the tax credit. Additional tax credits may also be available for homeowners in certain states. Tax incentives are subject to change or termination by executive, legislative or regulatory action. Sunnova makes no guarantees regarding eligibility of any of the solar system and/or battery’s costs for tax benefits. Sunnova does not provide tax advice. Contact your personal tax advisor for eligibility requirements.

- Statewide rising utility rates – Note: if you can not add the disclaimer, please use the following language “According to EIA’s state-by-state analysis”

- EIA’s state-by-state CAGR Analysis shows an increase in residential electricity rates across all US States since 1990. To see the CAGR Analysis for your state go to EIA Sales and Revenue (1990- Current) – click here

- 2017 Power outage data– Note: if you can not add the disclaimer, please use the following language “According to 2017 Eaton Blackout report”

- The area of each outage and number of customers affected varied per outage. Source: Eaton Blackout Tracker: United States Annual Report 2017 - click here.

- 2008-2017 Power outage data – Note: if you can not add the disclaimer, please use the following language “According to 2018 Eaton Blackout report”

- The area of each outage and number of customers affected varied per outage. Source: Eaton Blackout Tracker: United States Annual Report 2018 - click here

Maryland

Federal tax credit (only for loan products)

- May be eligible to claim some of the system’s cost as a credit on your federal taxes.

State Incentives (only for loan products)

- You may be eligible to earn $1000 rebate check for a PV solar system sized between 1- 20kW.

- You may be eligible to claim up to 30% of your battery storage costs, up to $5,000, on state income taxes.

- Earn one Solar Renewable Energy Credit (SREC) for every 1,000 kWh (1.0 Mwh) your solar system produces. The value of the credits can increase or decrease depending upon the SREC market value. You can sell your Certificates directly or with a third-party broker specialized in SRECs.

- Federal tax credit o You may be eligible for a federal tax credit with the purchase of a solar system and/or battery. To qualify for the tax credit, you must have federal income tax liability at least equal to the value of the tax credit. Additional tax credits may also be available for homeowners in certain states. Tax incentives are subject to change or termination by executive, legislative or regulatory action. Sunnova makes no guarantees regarding eligibility of any of the solar system and/or battery’s costs for tax benefits. Sunnova does not provide tax advice. Contact your personal tax advisor for eligibility requirements.

- Statewide rising utility rates – Note: if you can not add the disclaimer, please use the following language “According to EIA’s state-by-state analysis”

- EIA’s state-by-state CAGR Analysis shows an increase in residential electricity rates across all US States since 1990. To see the CAGR Analysis for your state go to EIA Sales and Revenue (1990- Current) – click here

- 2017 Power outage data– Note: if you can not add the disclaimer, please use the following language “According to 2017 Eaton Blackout report&rdquo

- The area of each outage and number of customers affected varied per outage. Source: Eaton Blackout Tracker: United States Annual Report 2017 - Click here

- 2008-2017 Power outage data – Note: if you can not add the disclaimer, please use the following language “According to 2018 Eaton Blackout report”

- The area of each outage and number of customers affected varied per outage. Source: Eaton Blackout Tracker: United States Annual Report 2018 - click here

New Mexico

Federal tax credit (only for loan products)

- May be eligible to claim some of the system’s cost as a credit on your federal taxes.

Federal tax credit

- You may be eligible for a federal tax credit with the purchase of a solar system and/or battery. To qualify for the tax credit, you must have federal income tax liability at least equal to the value of the tax credit. Additional tax credits may also be available for homeowners in certain states. Tax incentives are subject to change or termination by executive, legislative or regulatory action. Sunnova makes no guarantees regarding eligibility of any of the solar system and/or battery’s costs for tax benefits. Sunnova does not provide tax advice. Contact your personal tax advisor for eligibility requirements.

- Statewide rising utility rates – Note: if you can not add the disclaimer, please use the following language “According to EIA’s state-by-state analysis”

- EIA’s state-by-state CAGR Analysis shows an increase in residential electricity rates across all US States since 1990. To see the CAGR Analysis for your state go to EIA Sales and Revenue (1990- Current) – click here

- 2017 Power outage data– Note: if you can not add the disclaimer, please use the following language “According to 2017 Eaton Blackout report”

- The area of each outage and number of customers affected varied per outage. Source: Eaton Blackout Tracker: United States Annual Report 2017 - click here

- 2008-2017 Power outage data – Note: if you can not add the disclaimer, please use the following language “According to 2018 Eaton Blackout report”

- The area of each outage and number of customers affected varied per outage. Source: Eaton Blackout Tracker: United States Annual Report 2018 - click here

New Hampshire

Federal tax credit (only for loan products)

- May be eligible to claim some of the system’s cost as a credit on your federal taxes.

State Incentives (only for loan products)

- You may be eligible for a rebate program of $0.20 per watt up to $1,000, or 30% of the cost of the system for solar systems under 10 kilowatts (kW), whichever is less.

Federal tax credit

- You may be eligible for a federal tax credit with the purchase of a solar system and/or battery. To qualify for the tax credit, you must have federal income tax liability at least equal to the value of the tax credit. Additional tax credits may also be available for homeowners in certain states. Tax incentives are subject to change or termination by executive, legislative or regulatory action. Sunnova makes no guarantees regarding eligibility of any of the solar system and/or battery’s costs for tax benefits. Sunnova does not provide tax advice. Contact your personal tax advisor for eligibility requirements.

- Statewide rising utility rates – Note: if you can not add the disclaimer, please use the following language “According to EIA’s state-by-state analysis”

- EIA’s state-by-state CAGR Analysis shows an increase in residential electricity rates across all US States since 1990. To see the CAGR Analysis for your state go to EIA Sales and Revenue (1990- Current) – click here

- 2017 Power outage data– Note: if you can not add the disclaimer, please use the following language “According to 2017 Eaton Blackout report”

- The area of each outage and number of customers affected varied per outage. Source: Eaton Blackout Tracker: United States Annual Report 2017 - click here

- 2008-2017 Power outage data – Note: if you can not add the disclaimer, please use the following language “According to 2018 Eaton Blackout report”

- The area of each outage and number of customers affected varied per outage. Source: Eaton Blackout Tracker: United States Annual Report 2018 - click here

Colorado

Federal tax credit (only for loan products)

- May be eligible to claim some of the system’s cost as a credit on your federal taxes.

Federal tax credit

- You may be eligible for a federal tax credit with the purchase of a solar system and/or battery. To qualify for the tax credit, you must have federal income tax liability at least equal to the value of the tax credit. Additional tax credits may also be available for homeowners in certain states. Tax incentives are subject to change or termination by executive, legislative or regulatory action. Sunnova makes no guarantees regarding eligibility of any of the solar system and/or battery’s costs for tax benefits. Sunnova does not provide tax advice. Contact your personal tax advisor for eligibility requirements.

- Statewide rising utility rates – Note: if you can not add the disclaimer, please use the following language “According to EIA’s state-by-state analysis”

- EIA’s state-by-state CAGR Analysis shows an increase in residential electricity rates across all US States since 1990. To see the CAGR Analysis for your state go to EIA Sales and Revenue (1990- Current) – click here

- 2017 Power outage data– Note: if you can not add the disclaimer, please use the following language “According to 2017 Eaton Blackout report”

- The area of each outage and number of customers affected varied per outage. Source: Eaton Blackout Tracker: United States Annual Report 2017 - click here

- 2008-2017 Power outage data – Note: if you can not add the disclaimer, please use the following language “According to 2018 Eaton Blackout report”

- The area of each outage and number of customers affected varied per outage. Source: Eaton Blackout Tracker: United States Annual Report 2018 - click here

Texas

Federal tax credit (only for loan products)

- May be eligible to claim some of the system’s cost as a credit on your federal taxes.

Utility and City incentives (only for loan products)

- Austin Energy – you may be eligible to earn $2,500 rebate by completing their solar education course and installing a qualifying solar photovoltaic (PV) system on your home.

- CoServ Electric Cooperative – you may be eligible to earn isolar rebates on qualified purchases based on kW installed, up to a maximum of $3,100 per residential Member.

- CPS Energy in San Antonio – you may be eligible to earn a rebate incentive of $2,500 for qualifying residential project.

- You may be eligible for a federal tax credit with the purchase of a solar system and/or battery. To qualify for the tax credit, you must have federal income tax liability at least equal to the value of the tax credit. Additional tax credits may also be available for homeowners in certain states. Tax incentives are subject to change or termination by executive, legislative or regulatory action. Sunnova makes no guarantees regarding eligibility of any of the solar system and/or battery’s costs for tax benefits. Sunnova does not provide tax advice. Contact your personal tax advisor for eligibility requirements.

- Statewide rising utility rates – Note: if you can not add the disclaimer, please use the following language “According to EIA’s state-by-state analysis”

- EIA’s state-by-state CAGR Analysis shows an increase in residential electricity rates across all US States since 1990. To see the CAGR Analysis for your state go to EIA Sales and Revenue (1990- Current) – click here

- 2017 Power outage data– Note: if you can not add the disclaimer, please use the following language “According to 2017 Eaton Blackout report”

- The area of each outage and number of customers affected varied per outage. Source: Eaton Blackout Tracker: United States Annual Report 2017 - click here

- 2008-2017 Power outage data – Note: if you can not add the disclaimer, please use the following language “According to 2018 Eaton Blackout report”

- The area of each outage and number of customers affected varied per outage. Source: Eaton Blackout Tracker: United States Annual Report 2018 - click here

Connecticut

Federal tax credit (only for loan products)

- May be eligible to claim some of the system’s cost as a credit on your federal taxes.

Federal tax credit

- You may be eligible for a federal tax credit with the purchase of a solar system and/or battery. To qualify for the tax credit, you must have federal income tax liability at least equal to the value of the tax credit. Additional tax credits may also be available for homeowners in certain states. Tax incentives are subject to change or termination by executive, legislative or regulatory action. Sunnova makes no guarantees regarding eligibility of any of the solar system and/or battery’s costs for tax benefits. Sunnova does not provide tax advice. Contact your personal tax advisor for eligibility requirements.

- Statewide rising utility rates – Note: if you can not add the disclaimer, please use the following language “According to EIA’s state-by-state analysis”

- EIA’s state-by-state CAGR Analysis shows an increase in residential electricity rates across all US States since 1990. To see the CAGR Analysis for your state go to EIA Sales and Revenue (1990- Current) – click here

- 2017 Power outage data– Note: if you can not add the disclaimer, please use the following language “According to 2017 Eaton Blackout report”

- The area of each outage and number of customers affected varied per outage. Source: Eaton Blackout Tracker: United States Annual Report 2017 - click here

- 2008-2017 Power outage data – Note: if you can not add the disclaimer, please use the following language “According to 2018 Eaton Blackout report”

- The area of each outage and number of customers affected varied per outage. Source: Eaton Blackout Tracker: United States Annual Report 2018 - click here

Massachusetts

Federal tax credit (only for loan products)

- May be eligible to claim some of the system’s cost as a credit on your federal taxes.

Federal tax credit

- You may be eligible for a federal tax credit with the purchase of a solar system and/or battery. To qualify for the tax credit, you must have federal income tax liability at least equal to the value of the tax credit. Additional tax credits may also be available for homeowners in certain states. Tax incentives are subject to change or termination by executive, legislative or regulatory action. Sunnova makes no guarantees regarding eligibility of any of the solar system and/or battery’s costs for tax benefits. Sunnova does not provide tax advice. Contact your personal tax advisor for eligibility requirements.

- Statewide rising utility rates – Note: if you can not add the disclaimer, please use the following language “According to EIA’s state-by-state analysis”

- EIA’s state-by-state CAGR Analysis shows an increase in residential electricity rates across all US States since 1990. To see the CAGR Analysis for your state go to EIA Sales and Revenue (1990- Current) – click here

- 2017 Power outage data– Note: if you can not add the disclaimer, please use the following language “According to 2017 Eaton Blackout report”

- The area of each outage and number of customers affected varied per outage. Source: Eaton Blackout Tracker: United States Annual Report 2017 - click here

- 2008-2017 Power outage data – Note: if you can not add the disclaimer, please use the following language “According to 2018 Eaton Blackout report”

- The area of each outage and number of customers affected varied per outage. Source: Eaton Blackout Tracker: United States Annual Report 2018 - click here

Hawaii

Federal tax credit (only for loan products)

- May be eligible to claim some of the system’s cost as a credit on your federal taxes.

State Incentives (only for loan products)

- May be eligible to claim up to 25% of solar panel costs, up to $1,000, on state income taxes.

- Federal tax credit o You may be eligible for a federal tax credit with the purchase of a solar system and/or battery. To qualify for the tax credit, you must have federal income tax liability at least equal to the value of the tax credit. Additional tax credits may also be available for homeowners in certain states. Tax incentives are subject to change or termination by executive, legislative or regulatory action. Sunnova makes no guarantees regarding eligibility of any of the solar system and/or battery’s costs for tax benefits. Sunnova does not provide tax advice. Contact your personal tax advisor for eligibility requirements.

- Statewide rising utility rates – Note: if you can not add the disclaimer, please use the following language “According to EIA’s state-by-state analysis”

- EIA’s state-by-state CAGR Analysis shows an increase in residential electricity rates across all US States since 1990. To see the CAGR Analysis for your state go to EIA Sales and Revenue (1990- Current) – click here

- 2017 Power outage data– Note: if you can not add the disclaimer, please use the following language “According to 2017 Eaton Blackout report”

- The area of each outage and number of customers affected varied per outage. Source: Eaton Blackout Tracker: United States Annual Report 2017 - click here

- 2008-2017 Power outage data – Note: if you can not add the disclaimer, please use the following language “According to 2018 Eaton Blackout report”

- The area of each outage and number of customers affected varied per outage. Source: Eaton Blackout Tracker: United States Annual Report 2018 - click here

Federal tax credit

- You may be eligible for a federal tax credit with the purchase of a solar system and/or battery. To qualify for the tax credit, you must have federal income tax liability at least equal to the value of the tax credit. Additional tax credits may also be available for homeowners in certain states. Tax incentives are subject to change or termination by executive, legislative or regulatory action. Sunnova makes no guarantees regarding eligibility of any of the solar system and/or battery’s costs for tax benefits. Sunnova does not provide tax advice. Contact your personal tax advisor for eligibility requirements.

- Statewide rising utility rates – Note: if you can not add the disclaimer, please use the following language “According to EIA’s state-by-state analysis”

- EIA’s state-by-state CAGR Analysis shows an increase in residential electricity rates across all US States since 1990. To see the CAGR Analysis for your state go to EIA Sales and Revenue (1990- Current) – click here

- 2017 Power outage data– Note: if you can not add the disclaimer, please use the following language “According to 2017 Eaton Blackout report”

- The area of each outage and number of customers affected varied per outage. Source: Eaton Blackout Tracker: United States Annual Report 2017 - click here

- 2008-2017 Power outage data – Note: if you can not add the disclaimer, please use the following language “According to 2018 Eaton Blackout report”

- The area of each outage and number of customers affected varied per outage. Source: Eaton Blackout Tracker: United States Annual Report 2018 - click here

Arizona

Federal tax credit (only for loan products)

- May be eligible to claim some of the system’s cost as a credit on your federal taxes.

State Incentives (only for loan products)

- May be eligible to claim up to 25% of solar panel costs, up to $1,000, on state income taxes.

Utility Incentives (only mention for loan products)

- SRP Utility Customers – you may be eligible to earn a battery storage incentive in the amount of $300 per kWh-DC, up to $3600, when purchasing a battery and agreeing to participate in the utility’s battery research study.

Federal tax credit

- You may be eligible for a federal tax credit with the purchase of a solar system and/or battery. To qualify for the tax credit, you must have federal income tax liability at least equal to the value of the tax credit. Additional tax credits may also be available for homeowners in certain states. Tax incentives are subject to change or termination by executive, legislative or regulatory action. Sunnova makes no guarantees regarding eligibility of any of the solar system and/or battery’s costs for tax benefits. Sunnova does not provide tax advice. Contact your personal tax advisor for eligibility requirements.

- Statewide rising utility rates – Note: if you can not add the disclaimer, please use the following language “According to EIA’s state-by-state analysis”

- EIA’s state-by-state CAGR Analysis shows an increase in residential electricity rates across all US States since 1990. To see the CAGR Analysis for your state go to EIA Sales and Revenue (1990- Current) – click here

- 2017 Power outage data– Note: if you can not add the disclaimer, please use the following language “According to 2017 Eaton Blackout report”

- The area of each outage and number of customers affected varied per outage. Source: Eaton Blackout Tracker: United States Annual Report 2017 - click here

- 2008-2017 Power outage data – Note: if you can not add the disclaimer, please use the following language “According to 2018 Eaton Blackout report”

- The area of each outage and number of customers affected varied per outage. Source: Eaton Blackout Tracker: United States Annual Report 2018 - click here

California

Federal Tax Credit (only for loan products)

- May be eligible to claim some of the system’s cost as a credit on your federal taxes.

State Incentives (only for loan products)

- California Self Generating Incentive Program (SGIP) – Depending on the current step, you may be eligible to receive approximately $250/kilowatt-hour, which means the rebate covers approximately 25 percent of the cost of an average energy storage system.

Federal tax credit

- You may be eligible for a federal tax credit with the purchase of a solar system and/or battery. To qualify for the tax credit, you must have federal income tax liability at least equal to the value of the tax credit. Additional tax credits may also be available for homeowners in certain states. Tax incentives are subject to change or termination by executive, legislative or regulatory action. Sunnova makes no guarantees regarding eligibility of any of the solar system and/or battery’s costs for tax benefits. Sunnova does not provide tax advice. Contact your personal tax advisor for eligibility requirements.

- Statewide rising utility rates – Note: if you can not add the disclaimer, please use the following language “According to EIA’s state-by-state analysis”

- EIA’s state-by-state CAGR Analysis shows an increase in residential electricity rates across all US States since 1990. To see the CAGR Analysis for your state go to EIA Sales and Revenue (1990- Current) – click here

- 2017 Power outage data– Note: if you can not add the disclaimer, please use the following language “According to 2017 Eaton Blackout report”

- The area of each outage and number of customers affected varied per outage. Source: Eaton Blackout Tracker: United States Annual Report 2017 - click here

- 2008-2017 Power outage data – Note: if you can not add the disclaimer, please use the following language “According to 2018 Eaton Blackout report”

- The area of each outage and number of customers affected varied per outage. Source: Eaton Blackout Tracker: United States Annual Report 2018 - click here

South Carolina

Federal tax credit (only for loan products)

- May be eligible to claim some of the system’s cost as a credit on your federal taxes.

Federal tax credit

- You may be eligible for a federal tax credit with the purchase of a solar system and/or battery. To qualify for the tax credit, you must have federal income tax liability at least equal to the value of the tax credit. Additional tax credits may also be available for homeowners in certain states. Tax incentives are subject to change or termination by executive, legislative or regulatory action. Sunnova makes no guarantees regarding eligibility of any of the solar system and/or battery’s costs for tax benefits. Sunnova does not provide tax advice. Contact your personal tax advisor for eligibility requirements.

- Statewide rising utility rates – Note: if you can not add the disclaimer, please use the following language “According to EIA’s state-by-state analysis”

- EIA’s state-by-state CAGR Analysis shows an increase in residential electricity rates across all US States since 1990. To see the CAGR Analysis for your state go to EIA Sales and Revenue (1990- Current) – click here

- 2017 Power outage data– Note: if you can not add the disclaimer, please use the following language “According to 2017 Eaton Blackout report”

- The area of each outage and number of customers affected varied per outage. Source: Eaton Blackout Tracker: United States Annual Report 2017 - click here

- 2008-2017 Power outage data – Note: if you can not add the disclaimer, please use the following language “According to 2018 Eaton Blackout report”

- The area of each outage and number of customers affected varied per outage. Source: Eaton Blackout Tracker: United States Annual Report 2018 - click here

Florida

Federal Tax Credit (only for loan products)

- May be eligible to claim some of the system’s cost as a credit on your federal taxes.

Federal tax credit

- You may be eligible for a federal tax credit with the purchase of a solar system and/or battery. To qualify for the tax credit, you must have federal income tax liability at least equal to the value of the tax credit. Additional tax credits may also be available for homeowners in certain states. Tax incentives are subject to change or termination by executive, legislative or regulatory action. Sunnova makes no guarantees regarding eligibility of any of the solar system and/or battery’s costs for tax benefits. Sunnova does not provide tax advice. Contact your personal tax advisor for eligibility requirements.

- Statewide rising utility rates – Note: if you can not add the disclaimer, please use the following language “According to EIA’s state-by-state analysis”

- EIA’s state-by-state CAGR Analysis shows an increase in residential electricity rates across all US States since 1990. To see the CAGR Analysis for your state go to EIA Sales and Revenue (1990- Current) – click here

- 2017 Power outage data– Note: if you can not add the disclaimer, please use the following language “According to 2017 Eaton Blackout report”

- The area of each outage and number of customers affected varied per outage. Source: Eaton Blackout Tracker: United States Annual Report 2017 - click here

- 2008-2017 Power outage data – Note: if you can not add the disclaimer, please use the following language “According to 2018 Eaton Blackout report”

- The area of each outage and number of customers affected varied per outage. Source: Eaton Blackout Tracker: United States Annual Report 2018 - click here

Illinois

Federal tax credit (only for loan products)

- May be eligible to claim some of the system’s cost as a credit on your federal taxes.

Federal tax credit

- You may be eligible for a federal tax credit with the purchase of a solar system and/or battery. To qualify for the tax credit, you must have federal income tax liability at least equal to the value of the tax credit. Additional tax credits may also be available for homeowners in certain states. Tax incentives are subject to change or termination by executive, legislative or regulatory action. Sunnova makes no guarantees regarding eligibility of any of the solar system and/or battery’s costs for tax benefits. Sunnova does not provide tax advice. Contact your personal tax advisor for eligibility requirements.

- Statewide rising utility rates – Note: if you can not add the disclaimer, please use the following language “According to EIA’s state-by-state analysis”

- EIA’s state-by-state CAGR Analysis shows an increase in residential electricity rates across all US States since 1990. To see the CAGR Analysis for your state go to EIA Sales and Revenue (1990- Current) – click here

- 2017 Power outage data– Note: if you can not add the disclaimer, please use the following language “According to 2017 Eaton Blackout report”

- The area of each outage and number of customers affected varied per outage. Source: Eaton Blackout Tracker: United States Annual Report 2017 - click here

- 2008-2017 Power outage data – Note: if you can not add the disclaimer, please use the following language “According to 2018 Eaton Blackout report”

- The area of each outage and number of customers affected varied per outage. Source: Eaton Blackout Tracker: United States Annual Report 2018 - click here

New Jersey

Federal tax credit (only for loan products)

- May be eligible to claim some of the system’s cost as a credit on your federal taxes.

State incentive (only for loan products)

- Earn 60% of one Transition Renewable Energy Credit (TREC) for every 1,000 kWh (1.0 Mwh) your solar system produces. You can sell your TRECs directly to a TREC administrator.

Federal tax credit

- You may be eligible for a federal tax credit with the purchase of a solar system and/or battery. To qualify for the tax credit, you must have federal income tax liability at least equal to the value of the tax credit. Additional tax credits may also be available for homeowners in certain states. Tax incentives are subject to change or termination by executive, legislative or regulatory action. Sunnova makes no guarantees regarding eligibility of any of the solar system and/or battery’s costs for tax benefits. Sunnova does not provide tax advice. Contact your personal tax advisor for eligibility requirements.

- Statewide rising utility rates – Note: if you can not add the disclaimer, please use the following language “According to EIA’s state-by-state analysis”

- EIA’s state-by-state CAGR Analysis shows an increase in residential electricity rates across all US States since 1990. To see the CAGR Analysis for your state go to EIA Sales and Revenue (1990- Current) – click here

- 2017 Power outage data– Note: if you can not add the disclaimer, please use the following language “According to 2017 Eaton Blackout report”

- The area of each outage and number of customers affected varied per outage. Source: Eaton Blackout Tracker: United States Annual Report 2017 - click here

- 2008-2017 Power outage data – Note: if you can not add the disclaimer, please use the following language “According to 2018 Eaton Blackout report”

- The area of each outage and number of customers affected varied per outage. Source: Eaton Blackout Tracker: United States Annual Report 2018 - click here

New York

Federal tax credit (only for loan products)

- May be eligible to claim some of the system’s cost as a credit on your federal taxes.

State incentive (only for loan products)

- You may be eligible for a solar energy system equipment credit up to 25% of the qualified solar system equipment expenditure, up to $5,000, on state income taxes.

Federal tax credit

- You may be eligible for a federal tax credit with the purchase of a solar system and/or battery. To qualify for the tax credit, you must have federal income tax liability at least equal to the value of the tax credit. Additional tax credits may also be available for homeowners in certain states. Tax incentives are subject to change or termination by executive, legislative or regulatory action. Sunnova makes no guarantees regarding eligibility of any of the solar system and/or battery’s costs for tax benefits. Sunnova does not provide tax advice. Contact your personal tax advisor for eligibility requirements.

- Statewide rising utility rates – Note: if you can not add the disclaimer, please use the following language “According to EIA’s state-by-state analysis”

- EIA’s state-by-state CAGR Analysis shows an increase in residential electricity rates across all US States since 1990. To see the CAGR Analysis for your state go to EIA Sales and Revenue (1990- Current) – click here

- 2017 Power outage data– Note: if you can not add the disclaimer, please use the following language “According to 2017 Eaton Blackout report”

- The area of each outage and number of customers affected varied per outage. Source: Eaton Blackout Tracker: United States Annual Report 2017 - click here

- 2008-2017 Power outage data – Note: if you can not add the disclaimer, please use the following language “According to 2018 Eaton Blackout report”

- The area of each outage and number of customers affected varied per outage. Source: Eaton Blackout Tracker: United States Annual Report 2018 - click here

Rhode Island

Federal tax credit (only for loan products)

- May be eligible to claim some of the system’s cost as a credit on your federal taxes.

State incentive (only for loan products)

- With the Renewable Energy Fund, Small-Scale Program, you may be eligible to receive $0.85/W incentive when installing a solar system, up to $7,000 per project.

Federal tax credit

- You may be eligible for a federal tax credit with the purchase of a solar system and/or battery. To qualify for the tax credit, you must have federal income tax liability at least equal to the value of the tax credit. Additional tax credits may also be available for homeowners in certain states. Tax incentives are subject to change or termination by executive, legislative or regulatory action. Sunnova makes no guarantees regarding eligibility of any of the solar system and/or battery’s costs for tax benefits. Sunnova does not provide tax advice. Contact your personal tax advisor for eligibility requirements.

- Statewide rising utility rates – Note: if you can not add the disclaimer, please use the following language “According to EIA’s state-by-state analysis”

- EIA’s state-by-state CAGR Analysis shows an increase in residential electricity rates across all US States since 1990. To see the CAGR Analysis for your state go to EIA Sales and Revenue (1990- Current) – click here

- 2017 Power outage data– Note: if you can not add the disclaimer, please use the following language “According to 2017 Eaton Blackout report”

- The area of each outage and number of customers affected varied per outage. Source: Eaton Blackout Tracker: United States Annual Report 2017 - click here

- 2008-2017 Power outage data – Note: if you can not add the disclaimer, please use the following language “According to 2018 Eaton Blackout report”

- The area of each outage and number of customers affected varied per outage. Source: Eaton Blackout Tracker: United States Annual Report 2018 - click here

What is Net Metering and Why is it Important?

Net metering is one way you can financially benefit from installing a residential solar system.

Solar panels tend to make a lot of energy during the middle of the day, and the highest demand for electricity is typically in the evening. If your state supports net metering (many do by now, but to varying degrees), you can receive a credit on your electric bill by sending excess energy back to the grid and reduce your home's net electricity usage.

Essentially, net metering is a billing tool that allows solar customers to use the electric grid to “store” any solar energy that’s not immediately used. Then you can draw power from the grid when you need it and enjoy a lower cost of electricity overall, thanks to your net metering credits. There are various net metering programs in different states and utility areas. But understand that you may further reduce your electric bill with solar through this arrangement.

What About the Solar Panel Installation Cost?

If you are curious about how much solar panels cost, it generally depends on a few factors. These include:

- The size of your home solar system

- Whether you buy or lease

- Whether you qualify for federal, state, or local incentives

When installing solar on your home's roof, there are several factors to consider.

Electricity needs – How much energy you currently consume will directly relate to how big of a solar system you need and how many panels you need to support your home's energy needs.

Where you live – How much sun exposure your home's roof gets will directly correlate to how much energy your solar system can produce and will impact your solar system’s size. More sun means more energy produced and a greater potential to save with solar.

Choice of solar panels – Higher-efficiency panels produce more energy. The efficiency of the solar panels directly impacts the savings you can experience.

Roof angle – In solar panel installation, it is important to angle the solar panels so they can get maximum exposure to the sun. Houses with irregular rooflines, skylights, and challenging angles can make an installation more complicated, but not impossible.

Installation labor and project management – Different areas have different regulations regarding the installation of solar panels. In some areas, this process might require the contractor to pay more than the average cost or to spend more time than usual getting the license.

Purchasing options and incentives – The payment option you choose will affect your costs and eligibility for incentives.

When you choose Sunnova as your solar service provider, the cost of your solar system includes:

- Parts (solar panels, inverters, mounting equipment, conduit, and other components)

- Installation and labor

- Permitting and inspections

- Project management, including HOA approvals (if required)

In addition, all Sunnova solar systems come with 25 years of coverage, which includes:

- A dedicated customer care team that offers bilingual support seven days a week

- System monitoring that tracks solar and battery performance around the clock

- Online tools that provide access to this real-time production data

In most states, we offer an energy guarantee with certain finance agreements, promising that your system will generate the amount of energy outlined in your contract, or we will refund or credit you for the difference.

Leasing Solar Panels vs. Buying Solar Panels

Sunnova offers several types of energy plans, so you'll have an easier time choosing an affordable, worry-free solar energy plan for your home. There are pros and cons for each from a cost perspective.

With a solar lease and power purchase agreement (PPA), a third party owns your solar panels, and you agree to pay monthly. A PPA allows you to pay only for the energy your panels generate, while a lease lets you pay an agreed-upon amount for the duration of your lease.

You can also buy your panels outright with a loan. Click here to learn more about these solar financing options.

When choosing the right financing option, it is also important to consider the following:

- Do you have enough tax liability to claim some or all of your solar system costs on your federal income taxes? If your taxes are more than your solar credit, a loan may make the most sense since you can take full advantage of the federal tax credit. Even if you don't use it all in the first year, you can "roll over" the remaining credits into future years for as long as the tax credit is in effect.*

- Does your state or utility offer incentives for going solar or installing a battery? If so, a loan/finance agreement may be a great option for you since you would be eligible to apply for these incentives.

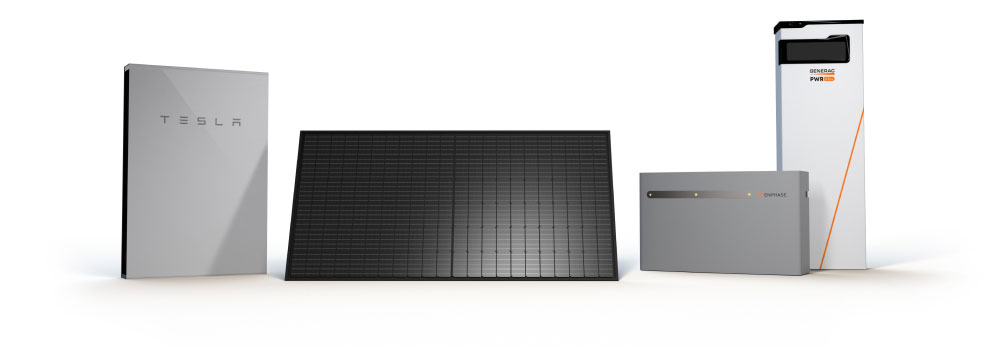

What Impact Does Adding a Battery Have on Solar Panel Costs?

Here are some important things to know about adding battery backup power to your home solar system:

Just as the cost of solar panel installation has drastically diminished over the past few years, the price of lithium-ion batteries has also fallen significantly.

In addition, work is ongoing to make battery technology longer lasting and less expensive, in the hopes of making widespread storage adoption a reality.*

Solar panels alone lack the ability to store power. If the grid goes down, your panels are designed to shut off due to safety concerns. Therefore, adding a battery to your solar panels is the only way to keep your power on during an outage. By storing solar energy in a battery, you can power your most-needed lights and appliances during a grid interruption.*

You can also store energy for later use when electricity from the grid is more expensive, such as during peak demand times. This can provide additional potential to save money on your electricity costs.

See how long a home battery backup can power your home with Sunnova’s home battery backup calculator.

A Push to Pair Battery Storage with Solar

As an increase in severe weather threatens the reliability of our electric grid, some states are making drastic efforts to push solar storage adoption.

In December of 2022, the California Public Utilities Commission (CPUC) voted to change the state’s net metering policy with the goal of better balancing the electricity supply and demand. The new policy, NEM 3.0, slashes the value of solar exported to the grid by such a degree that after mid-April, solar panels make the most financial sense with battery backup.

While the solar plus battery pairing is still somewhat new, the growth over the next five years is expected to be significant. By 2025, more than 25% of all residential solar systems will be paired with storage, compared to less than 5% in 2019.*

The Bottom Line on Solar Panel Cost vs. Savings

What we know today:

- The cost to go solar has decreased, while the technology has improved

- There are several factors to consider when deciding to install solar

- Battery costs have also declined significantly, with proven benefits for homeowners

Not surprisingly, home solar system configurations can vary greatly, based on all we've learned above. So clearly, the best way (perhaps the only way) to find out how much it will cost to go solar is to get a quote.

Remember that each home is unique, and energy needs can change considerably from one household to the next. Therefore, speaking to a Sunnova expert is crucial to understanding how much solar panels cost in your area.

Our dealers are committed to building you a customized solar system that meets your energy needs while considering your roof size, electricity consumption, desired offset and more.